Even with the recent drop in rates, understanding your options for a mortgage can feel daunting even to the most experienced borrowers. But don’t let that deter you. If other homebuyers’ experiences are any indication, odds are you’ll find a home loan that works well for you.

Continue reading Your Mortgage Options: Top Factors to Consider →

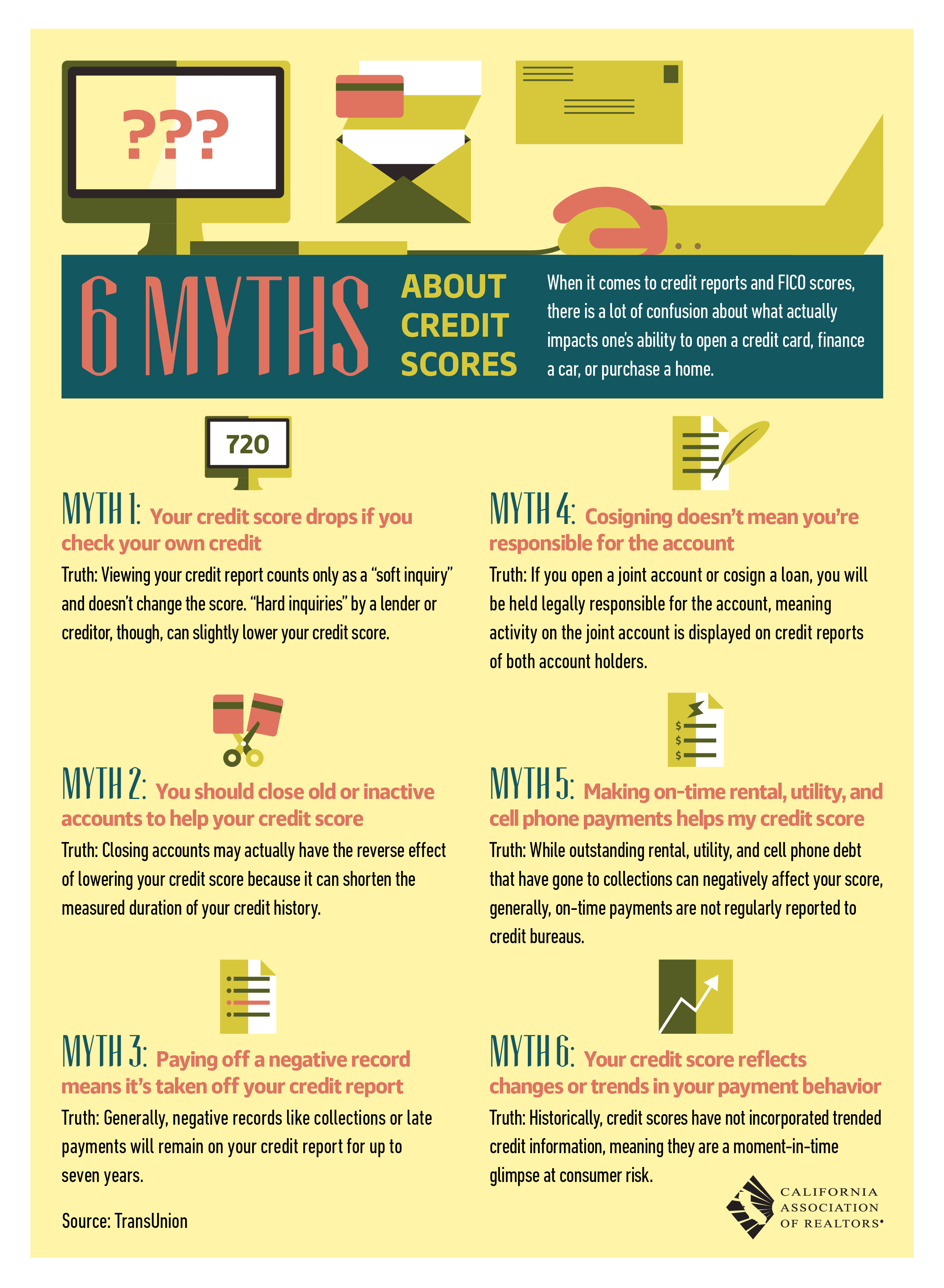

If you’re thinking about buying a home, you’ve probably received your share of advice from family and friends. Add to that the constant stream of TV shows, news segments, and social media posts that over-simplify the home buying process for easy entertainment.

With so much information to sift through, it can be tough to distinguish fact from fiction. That’s why I’m revealing the truth behind some of the most common home buyer myths and misconceptions.

Continue reading Top 10 Home Buyer Myths →

No matter if you’re in a buyer’s or seller’s market, there are a few critical steps you can take to make a smarter purchase. Since buying a home is likely the biggest single investment you will ever make, being prepared will help you make a better purchase. Here are 7 tips and tricks to buying a home.

No matter if you’re in a buyer’s or seller’s market, there are a few critical steps you can take to make a smarter purchase. Since buying a home is likely the biggest single investment you will ever make, being prepared will help you make a better purchase. Here are 7 tips and tricks to buying a home.

Know Your Buying Power

What is your buying power? It is your ability to borrow plus the cash you have available for a down payment and closing costs. Your credit-worthiness and income will affect how much you can realistically borrow for a home.

Continue reading How to Buy a Home: 7 Tips and Tricks from Real Estate Insiders →

You are probably aware that federal law entitles you to a free copy of your credit report annually by each of the three credit bureaus: TransUnion, Experian, and Equifax.

You are probably aware that federal law entitles you to a free copy of your credit report annually by each of the three credit bureaus: TransUnion, Experian, and Equifax.

Why bother to check your credit? Because by regularly looking at each of these reports, you can determine if there are any errors on them and be aware of your credit worthiness.

Continue reading Check Your Credit →

Some people take their credit for granted and don’t start paying attention to it until they need it. Doing this could cause them to pay more interest or keep them from getting a loan altogether.

There are several things that can kill your credit score. Knowing what they are and dealing with them ahead of time will save you time, money and headaches.

Continue reading Things That Can Kill Your Credit Score →

Buy, Sell, Live, Love North County & San Diego Homes

No matter if you’re in a buyer’s or seller’s market, there are a few critical steps you can take to make a smarter purchase. Since buying a home is likely the biggest single investment you will ever make, being prepared will help you make a better purchase. Here are 7 tips and tricks to buying a home.

No matter if you’re in a buyer’s or seller’s market, there are a few critical steps you can take to make a smarter purchase. Since buying a home is likely the biggest single investment you will ever make, being prepared will help you make a better purchase. Here are 7 tips and tricks to buying a home. You are probably aware that federal law entitles you to a free copy of your credit report annually by each of the three credit bureaus: TransUnion, Experian, and Equifax.

You are probably aware that federal law entitles you to a free copy of your credit report annually by each of the three credit bureaus: TransUnion, Experian, and Equifax.