The North County and San Diego housing markets maintained a steady pace in January.

Over nearly the past two years, price growth has been fairly limited. Median home prices today are only slightly higher than they were in mid-2024, which tells us the market has largely settled into a stable range after the rapid gains of prior years.

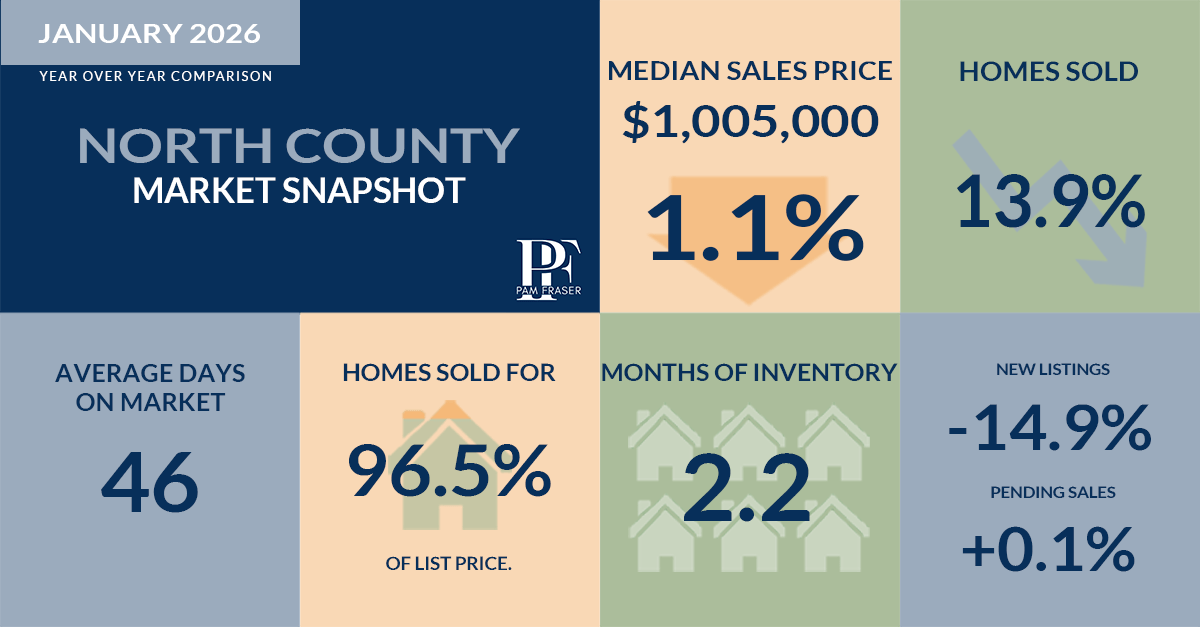

Year-over prices rose 2.3 percent across San Diego County, while North County dipped 1.1 percent compared to last January. New listings and closed sales were both lower than a year ago. Homes are taking a bit longer to sell, and sellers are receiving slightly less of their original asking price.

Affordability improved somewhat, due in part to slightly lower mortgage rates and gradual income growth. Even so, buyer activity remains cautious.

Recent reporting from The San Diego Union-Tribune notes that affordability challenges and slower sales activity are persisting statewide, which mirrors what we’re seeing here locally.

Historically, February and March mark the beginning of the seasonal lift in both pricing and sales activity. If that pattern holds, we could see some upward movement as we head into spring. Whether that turns into meaningful appreciation will depend largely on mortgage rates and overall economic stability.

Below are answers to some of the most common questions about current market conditions.

San Diego Housing Market FAQs

Are home prices rising in San Diego County?

Year-over-year, median prices are up 2.3 percent across San Diego County. However, prices remain near the levels reached in mid-2024, indicating market has largely moved sideways over the past two years.

Why has price growth slowed?

Mortgage rates remain well above the historic lows seen during the pandemic years. That shift reduced affordability and slowed buyer demand. While rates have eased somewhat, they are still high enough to prevent rapid price growth.

Is affordability improving?

Slightly. Lower mortgage rates compared to last year, along with gradual income growth, have helped. However, home prices remain elevated relative to incomes, which continue to limit how quickly demand can rebound.

What should we expect this spring?

Spring and early summer are typically the most active times of year for real estate. If that seasonal pattern holds, we should see more listings and increased buyer activity. How strong the market becomes will depend largely on mortgage rates and economic confidence.

Is this a buyer’s or seller’s market right now?

While the overall San Diego County market still has a slight sellers’ advantage, conditions in many areas and price ranges are relatively balanced. Buyers have more negotiating room than they did during the peak frenzy years, but well-priced homes are still attracting serious interest.

Looking for more detail or wondering what your home is worth in today’s market? I’m happy to help — request a free home valuation.

Interest Rates

Below are current mortgage rate averages and recent changes, updated regularly.

Market Updates

Click on the links below to read the San Diego real estate market reports.

- NORTH COUNTY MONTHLY INDICATORS

- METRO SAN DIEGO COUNTY MARKET UPDATE

- EAST SAN DIEGO COUNTY MARKET UPDATE

- SOUTH SAN DIEGO COUNTY MARKET UPDATE

- SAN DIEGO COUNTY MONTHLY INDICATORS

- 2025 SAN DIEGO COUNTY MARKET REPORT

North County Housing Summary

Here’s how the North County market performed compared to last year.

- Median home prices dropped 1.1 percent year-over.

- Detached home prices decreased 2.6 percent, from $1,155,000 to $1,125,000.

- Sold units decreased 13.9 percent. Pending sales grew 0.1 percent.

- Median days on market grew to 46, up 4.5 percent from last year.

- Inventory decreased from 3.1 months 2.2 months.

San Diego County Housing Summary

Here are the numbers for San Diego County.

- Median prices rose 2.3 percent year over, from $885,000 to $905,000.

- Detached home prices increased 2.0 percent, from $1,048,600 to $1,070,000.

- Attached home prices dropped 4.4 percent to $632,000.

- Inventory decreased from 2.4 months to 2.1 months.